Introduction

Roku has emerged as a significant player in the streaming industry, known for its streaming players and a platform that hosts a wide range of content. As more consumers cut the cord with traditional cable services, Roku’s importance in the entertainment ecosystem continues to grow. However, when deciding whether Roku stock is a buy, sell, or hold, it’s crucial to analyze its financial health, market competition, and growth potential. The evolving media landscape and Roku’s strategic responses to these changes will heavily influence its stock performance.

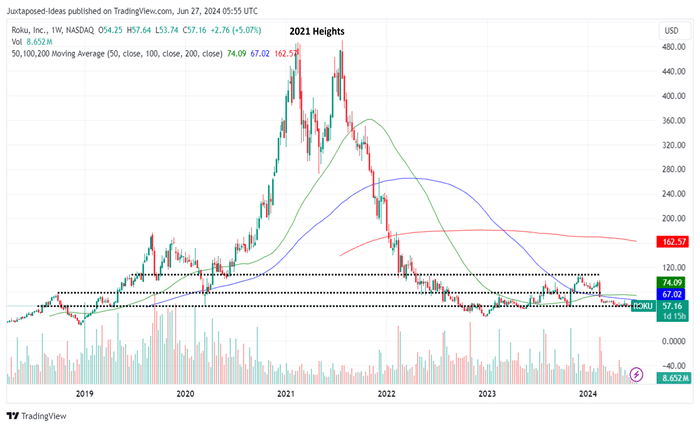

Analyzing Recent Performance of Roku Stock

Roku’s financial performance in recent quarters provides vital clues about its viability as an investment. Analyzing key metrics such as revenue growth, profit margins, and subscriber increases can help investors understand whether Roku stock is a buy, sell, or hold. Additionally, considering how Roku has managed operational costs and its ability to generate profit in a competitive market is crucial. This assessment will look at Roku’s earnings reports and what they indicate about the company’s future.

Roku’s Competitive Edge in the Streaming Market

To determine if roku stock examining its position relative to competitors like Amazon Fire, Apple TV, and Google Chromecast is essential. Roku’s unique selling proposition lies in its user-friendly interface and neutral platform that does not prioritize any content provider over others. This impartiality could be a significant advantage as content providers and advertisers look for neutral platforms to reach their audience.

Impact of Market Trends on Roku

Streaming is a rapidly evolving industry, with new technologies and consumer behaviors influencing market dynamics. The impact of these trends on Roku and subsequently on the “Roku stock buy sell or hold” decision cannot be underestimated. Factors such as the adoption of smart TVs, changes in content consumption habits, and regulatory changes need to be considered to predict Roku’s market trajectory accurately.

Financial Health and Profitability of Roku

A thorough analysis of Roku’s balance sheet, income statement, and cash flow statements will help determine if Roku stock is a buy, sell, or hold. Key indicators to focus on include liquidity ratios, debt levels, and cash reserves. Financial health is crucial for Roku’s ability to invest in new technologies and content, which could drive future growth.

Roku’s Growth Strategy and Future Outlook

Roku’s growth strategy, focusing on international expansion and content partnerships, is pivotal in deciding if Roku stock is a buy, sell, or hold. Plans to enter new geographic markets and enhance content offerings can potentially increase its user base and revenue. However, the success of these initiatives depends on execution and market reception.

Technology Innovations by Roku

Innovation is at the heart of Roku’s business model. Understanding the company’s investment in research and development and its output in terms of new products and services is vital. Whether these innovations can meet consumer expectations and fend off competition will influence if Roku stock is a buy, sell, or hold.

Read more about : however synonym

Regulatory Challenges Facing Roku

Like any company in the digital and entertainment sectors, Roku faces regulatory challenges that can impact its business operations and stock value. This section will explore potential legal hurdles for Roku, including privacy concerns and copyright laws, which could affect its business model and the “Roku stock buy sell or hold” decision.

Investor Sentiment and Stock Performance

Investor sentiment can greatly influence stock prices. This analysis will gauge market sentiment towards Roku and how this sentiment has historically correlated with the stock’s price movements. Understanding these dynamics is crucial for investors wondering if Roku stock is a buy, sell, or hold.

Expert Opinions on Roku Stock

Gathering insights from financial analysts and market experts can provide a broader perspective on Roku’s stock performance. This section will summarize what leading analysts are saying about Roku stock and how their forecasts might influence an individual’s decision to buy, sell, or hold.

Conclusion

Based on the detailed analysis, Roku presents a compelling case for different types of investors. However, making a decision on whether Roku stock is a buy, sell, or hold depends on individual investment goals, risk tolerance, and market outlook. Investors should consider both the potential risks and opportunities before making any stock transactions.

FAQs:

1. What are the key factors to consider when deciding if Roku stock is a buy, sell, or hold?

Key factors include Roku’s financial health, market position, growth strategy, and the overall streaming industry’s trends.

2. How does Roku’s competitive edge affect its stock?

Roku’s neutral platform and user-friendly interface give it a competitive advantage that could influence its stock positively.

3. What are the potential risks involved with investing in Roku stock?

Risks include intense competition, regulatory challenges, and market volatility in the tech and entertainment sectors.

4. How important is investor sentiment in influencing Roku stock?

Investor sentiment can significantly impact Roku’s stock price, especially in response to market trends and company performance.

5. Should I consult a financial advisor before making a decision on Roku stock?

Yes, consulting with a financial advisor is recommended to get personalized advice and to better understand how Roku fits into your overall investment strategy.